What Is CFD Trading?

A Contract for Difference lets you trade price movements without buying the actual asset. Think of it as betting on whether prices go up or down. You profit when your prediction is correct.

The beauty lies in simplicity. No need to store gold bars or manage stock certificates. Just focus on price direction and market timing.

How CFDs Work

Price tracking forms the core of CFD mechanics. When Tesla stock moves $10 higher, your Tesla CFD gains the same value. This direct link makes CFDs transparent and easy to understand.

Opening positions requires minimal capital thanks to leverage. A $1000 gold trade might only need $100 from your account with 1:10 leverage. The remaining $900 comes from borrowed funds.

Profits and losses multiply accordingly. That $10 Tesla move becomes $100 profit if you hold 10 CFDs. But losses work the same way, making risk management essential.

Benefits of Trading CFDs

CFD trading offers unique advantages over traditional investing:

- Tax efficiency: Different tax treatment compared to owning actual assets

- Profit from falling prices: Short selling lets you make money when markets drop

- Small capital requirements: Leverage means you can start with less money

- Multiple markets: Trade everything from currencies to crypto in one place

- No physical delivery: Never worry about storing commodities or managing shares

- Fast execution: Enter and exit positions quickly during market movements

CFD Instruments Available On Exness

Thousands of trading opportunities await through Exness CFDs. The platform covers major asset classes that South African traders want to access. From local currency pairs to international stocks, the selection meets diverse trading needs.

Forex CFDs

Currency pairs dominate the CFD landscape. Major pairs like EUR/USD and GBP/USD offer tight spreads and high liquidity. The USD/ZAR pair attracts local traders wanting to hedge rand exposure.

Forex CFDs never sleep during weekdays. Markets open Sunday evening and close Friday night, providing constant trading opportunities. This schedule suits different work patterns and trading styles perfectly.

Stock CFDs

Individual company shares become accessible without massive capital requirements. Apple, Amazon, Google – all available as CFDs with fractional trading. Own 0.1 shares of expensive stocks instead of buying full positions.

Earnings seasons create volatility that CFD traders love. Quick price movements offer profit opportunities that stock investors might miss. Corporate announcements, merger news, and quarterly results drive significant price swings.

Commodity CFDs

Raw materials like gold, oil, and agricultural products provide portfolio diversification. These markets often move independently from stocks and currencies. Economic uncertainty typically boosts precious metals demand.

Supply disruptions create trading opportunities. Weather affecting crops, political issues impacting oil, or mining strikes influencing metals – all generate price movements that alert traders can exploit.

Cryptocurrency CFDs

Digital assets bring 24/7 trading excitement. Bitcoin, Ethereum, and altcoins never close, creating round-the-clock opportunities. Extreme volatility means large profit potential but equally significant risks.

News drives crypto markets more than traditional analysis. Regulatory announcements, adoption news, or technical developments can move prices 20% in hours. Fast reactions and tight risk management become crucial.

Advantages of Trading CFDs With Exness

Competitive conditions make Exness attractive for CFD trading South Africa. The broker combines low costs with reliable execution and flexible account options. These factors create an environment where traders can focus on strategy rather than platform limitations.

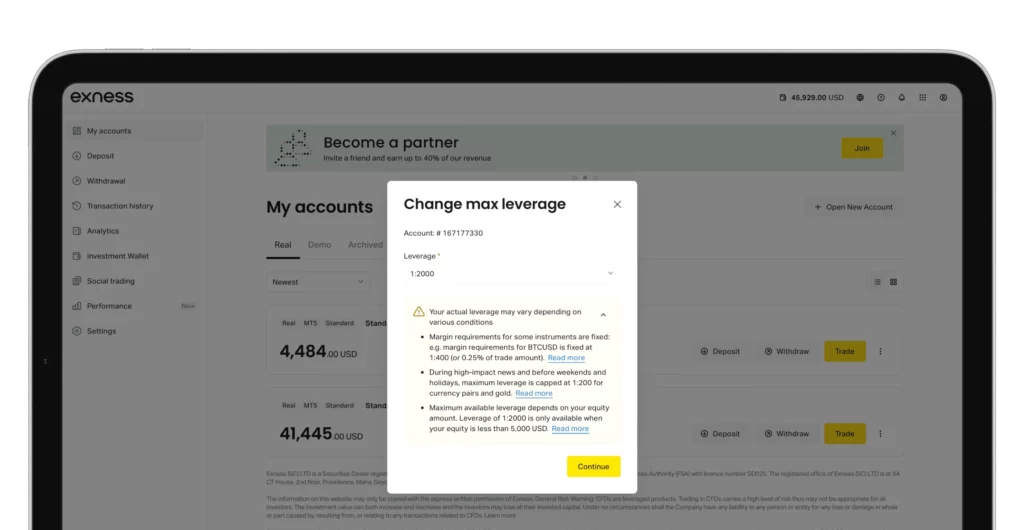

Leverage Opportunities

Exness leverage varies by instrument and trader classification. Professional accounts access higher ratios while maintaining reasonable risk controls. Forex CFDs offer the highest leverage, often reaching 1:2000 for qualified traders.

Smart leverage use amplifies profits without destroying accounts. A 1% market move with 1:50 leverage creates 50% returns. But the same leverage turns 1% losses into 50% account damage. Experience guides appropriate leverage selection.

Low Spreads and Commissions

Tight spreads reduce trading costs significantly. Every pip saved on spreads goes directly to profit potential. Low spreads Exness provides help frequent traders maintain profitability.

| Asset Class | Starting Spread | Commission Structure |

| Major Forex | 0.1 pips | None |

| Stock CFDs | 0.1% | $0.02 per share |

| Gold CFDs | 0.03 points | None |

| Crypto CFDs | 0.1% | None |

Flexible Trading Hours

Different markets operate on various schedules, providing trading opportunities around the clock.

| Market Category | Active Hours (GMT) | Trading Days |

| Forex Pairs | 00:05 – 23:55 | Mon-Fri |

| US Stocks | 14:30 – 21:00 | Mon-Fri |

| Commodities | 01:00 – 23:00 | Mon-Fri |

| Cryptocurrencies | 24/7 | Every day |

How To Start CFD Trading With Exness

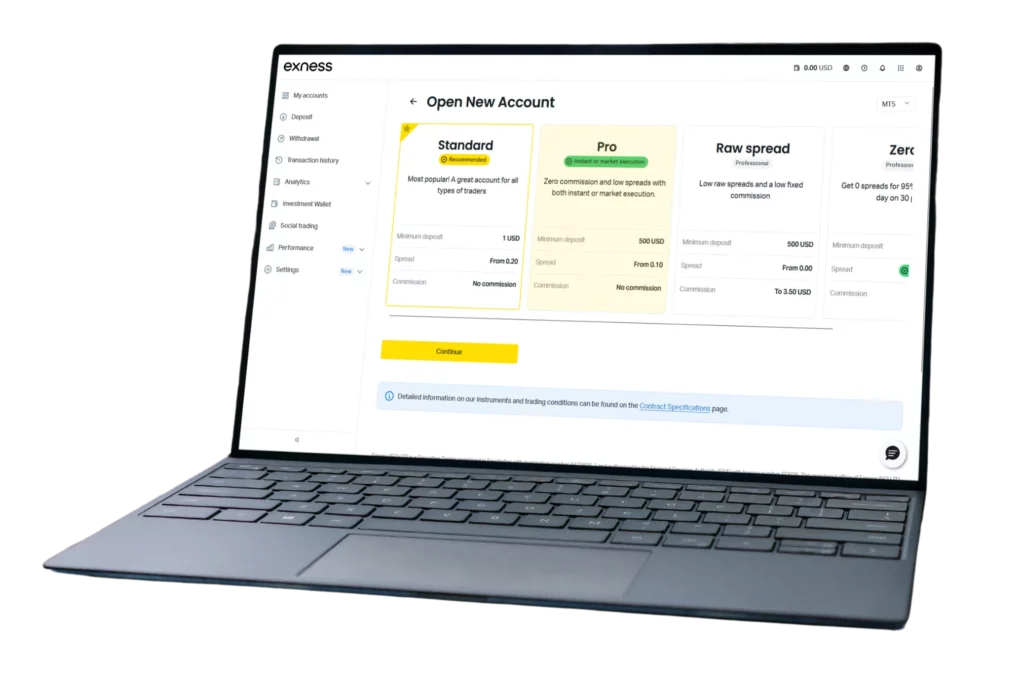

Account setup takes minutes but choosing the right type matters for long-term success. Different accounts suit different trading approaches and experience levels. Understanding options before opening prevents future complications.

Account Types Suitable for CFD Trading

EachExness account type serves specific trading needs and preferences:

- Standard Cent: Perfect for beginners with small deposits and learning focus

- Standard: Most popular choice offering balanced features and requirements

- Professional: Advanced tools and higher leverage for experienced traders

- Raw Spread: Minimal spreads with small commission charges

- Zero: Zero spreads on major pairs during specific hours

- Pro: Institutional features for serious high-volume trading

Deposit and Withdrawal Methods

South African payment options include local bank transfers, international cards, and popular e-wallets. Processing speeds vary from instant electronic methods to 2-3 day bank transfers. Most methods work for both deposits and withdrawals.

Minimum deposits start as low as $1 for cent accounts. This accessibility lets new traders start small while learning. Higher account types require larger minimums but offer better trading conditions.

Using Trading Platforms for CFDs

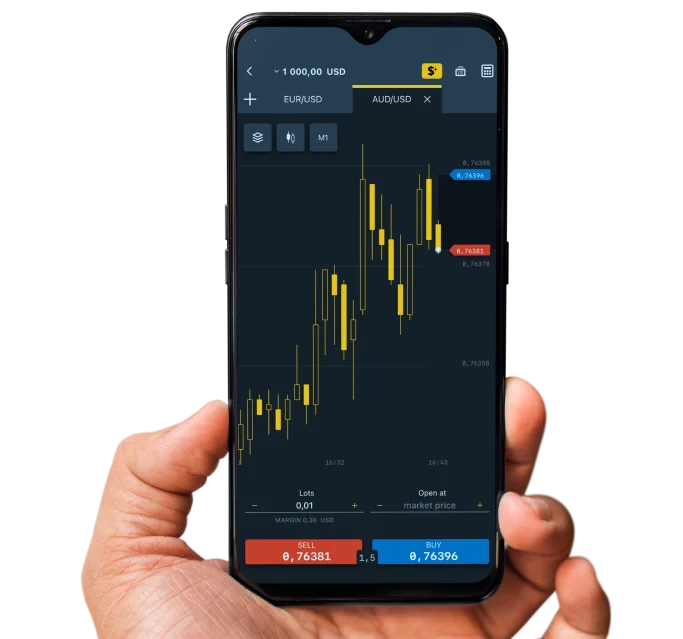

Platform choice affects daily trading experience significantly. Exness MetaTrader 4 dominates forex CFD trading with its familiar interface and extensive indicators. MetaTrader 5 adds more asset classes and advanced features.

CFD trading platform Exness mobile apps provide full functionality anywhere. Place trades, monitor positions, and analyze charts from smartphones or tablets. Internet connectivity is the only requirement for complete market access.

Risk Management In CFD Trading

Leverage amplifies both gains and losses equally. Successful CFD traders protect capital first, seek profits second. Risk management separates profitable traders from those who lose accounts quickly.

Essential risk management rules include:

- Never risk more than 2% per trade: Account survival depends on limiting individual losses

- Use stop losses religiously: Every position needs predetermined exit points

- Size positions appropriately: Larger accounts can handle bigger positions safely

- Diversify across markets: Don’t put all capital in one instrument type

- Control leverage usage: High leverage requires exceptional skill and discipline

- Keep trading records: Track what works and what doesn’t over time

- Stay educated: Markets evolve, requiring continuous learning and adaptation

- Manage emotions: Fear and greed destroy more accounts than bad analysis

Start trading online in South Africa

Discover why Exness is the broker of choice for over 1 million traders and 100,000 partners worldwide.

FAQs

What is CFD trading with Exness?

CFD trading with Exness lets South African traders bet on price changes in forex, stocks, commodities, and crypto without owning them, with high leverage and low spreads.

Which assets can I trade as CFDs?

Exness offers forex CFDs, stock CFDs, commodity CFDs, and cryptocurrency CFDs, including currency pairs, global stocks, metals, oil, and coins like Bitcoin.

What leverage does Exness offer for CFDs?

Exness leverage ranges up to 1:2000 for forex CFDs, with lower ratios for stocks and commodities, depending on the account and market.

How can traders manage risk in CFD trading?

Traders can use stop-loss and take-profit orders, diversify trades, limit leverage, and stay informed about market events to manage risks effectively.

Can I trade CFDs on mobile platforms?

Yes, Exness offers mobile apps for iOS and Android, letting South African traders trade CFDs, monitor markets, and manage accounts anywhere.