Step 1 – Learn the Basics of Stock Trading

Trading stocks means buying and selling pieces of companies listed on exchanges like the NYSE or NASDAQ. Shares are small chunks of ownership, and their prices shift based on what people think a company is worth. Some companies pay dividends, giving traders extra cash. Knowing terms like “market order” (buying at the current price) or “limit order” (setting a specific price) is a must.

Markets move for many reasons. A company’s earnings report can push its stock price up or down. Economic news or global events also play a role. Beginners should stick to big, stable companies like Coca-Cola or Google at first. These are less risky than small, volatile stocks. Use free tools like Google Finance to track prices and read company reports.

Here’s what to focus on:

- Learn key terms: shares, dividends, orders.

- Follow company news and earnings.

- Start with well-known stocks.

- Check free resources for data.

Without the basics, trading is just guessing. Take time to learn, and it pays off.

Step 2 – Open a Trading Account With Exness

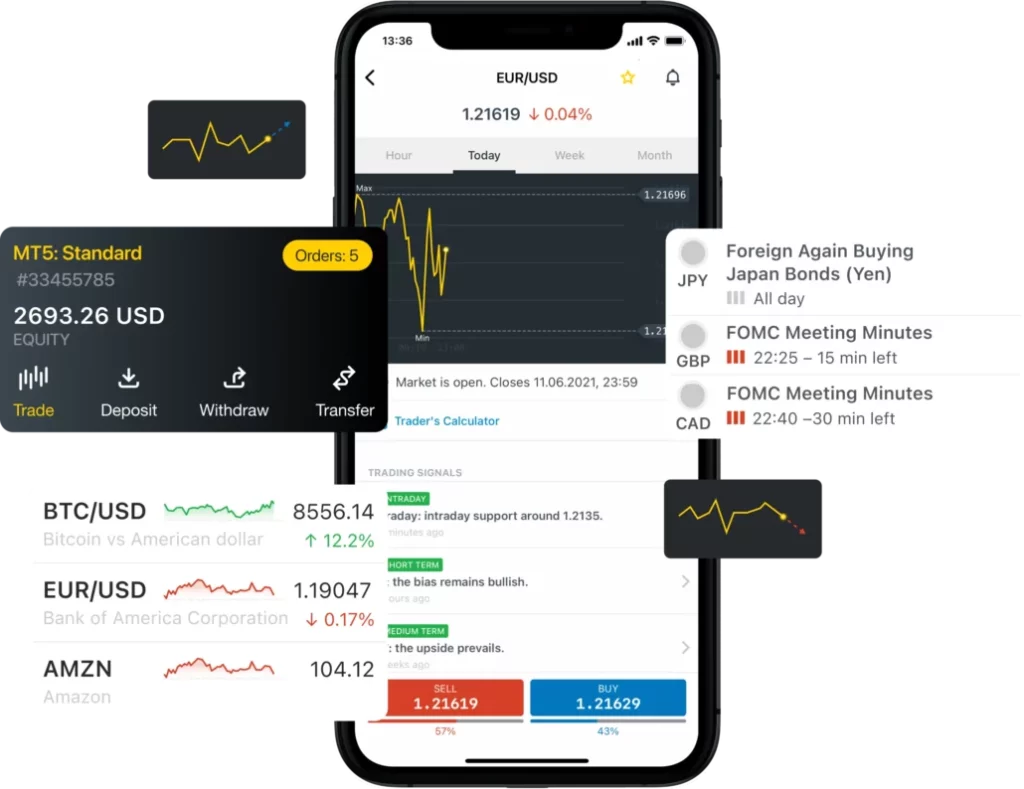

Starting with Exness share trading is simple. Head to website and pick an Exness account type.The Standard account is great for beginners—low deposit, easy access to stocks. Sign up with basic details, verify identity with an ID, and add funds. It takes less than ten minutes.

Exness uses the MT5 platform, which is fast and packed with tools like charts and indicators. Funding is flexible—use a card, e-wallet, or even crypto. Most deposits are fee-free. A tip: start small, maybe $50, to get comfortable.

| Account Type | Minimum Deposit | Best For |

| Standard | $10 | New traders |

| Pro | $200 | Advanced traders |

| Zero | $200 | Tight spreads |

Download MT5 after registration. Log in to Exness and you are ready to explore how to trade stocks.

Step 3 – Set Personal Rules and Stick to Them

Trading without rules is a recipe for trouble. Set clear limits before jumping in. Risk only 1-2% of your account per trade. For a $500 account, that’s $5-$10 max per trade. Stick to it, even if a stock looks “perfect.” Emotions can wreck trades, so rules keep things steady.

Pick trading hours that work. U.S. stock markets run from 9:30 AM to 4:00 PM EST. Don’t trade when you’re stressed or tired—it clouds judgment. Another rule: never chase a losing trade. If a stock drops, don’t throw more money at it hoping for a rebound. Write rules in a notebook or app. Check them daily.

Sample trading rules:

- Risk 1% per trade.

- Trade only 10 AM–1 PM.

- Stop if losses hit 4% in a day.

- Research every stock before buying.

Rules are like guardrails. They keep trading safe and focused.

Step 4 – Practice on a Demo Account

Jumping into real trades without practice is risky. Exness offers a free demo account with virtual money that feels like the real thing. It’s the best way to learn how to trade shares without losing cash. Test trades, try different order types, and watch how stocks move when news hits.

Spend a few weeks on the demo account. Trade stocks like Netflix or Walmart to see how prices react to earnings or market trends. Keep a log of trades to spot patterns. If you’re losing virtual money, figure out why before going live..

Step 5 – Choose Your Trading Strategy

A trading strategy is your roadmap. Day trading means quick buys and sells in a day, chasing fast profits but with high risk. Swing trading holds stocks for days or weeks, balancing risk and time. Long-term investing buys shares in companies like Apple for steady growth over months. Use charts for technical analysis—check moving averages or support levels. Study company earnings for fundamental analysis.

Pick one:

- Day Trading: Fast, risky, needs constant attention.

- Swing Trading: Moderate risk, hold for days.

- Long-Term Investing: Low risk, long-term gains.

Test on a demo account. Match the strategy to your schedule and risk comfort. A solid plan sharpens Exness share trading.

Step 6 – Start Trading Real Stocks With Exness

Time to trade. Log into Exness MT5, pick a stock like Tesla or Walmart from the market watch. Check price trends on the chart. Use market orders for instant trades or limit orders for specific prices. Start with $50 to keep risk low. Set stop-loss at 2% below buy price to limit losses, and take-profit to lock gains.

Trade during peak hours, like 10 AM–2 PM EST for U.S. stocks. Keep a journal to track trades. Starting stock trading with Exness is simple if you stay disciplined.

Tips for Beginners – How to Survive Stock Trading

Stock trading rewards patience. Only risk spare cash—10% of savings max. Stay updated with apps like Reuters for market news. Ignore social media hype; it’s often misleading. Don’t overtrade; one or two solid trades beat a dozen rushed ones. If a trade flops, don’t panic—learn and move on.

| Tip | Why It Helps |

| Risk spare cash | Keeps finances safe |

| Skip overtrading | Cuts mistakes |

| Follow news | Spots price drivers |

| Stay calm | Avoids rash moves |

Learn from losses. Smart habits and using trusted brokers like Exness in South Africa make stock trading less daunting.

Start trading online in South Africa

Discover why Exness is the broker of choice for over 1 million traders and 100,000 partners worldwide.

FAQs

How do I start trading stocks on Exness?

Sign up on Exness, pick a Standard account, verify ID, and deposit $10 or more. Use MT5 to select stocks like Amazon. Place trades with market or limit orders. Practice on a demo first to get the hang of it.

Can beginners trade shares on Exness?

Yes. Exness suits beginners with low deposits and an easy MT5 platform. Standard accounts give access to stocks like Microsoft. Demo accounts help practice risk-free. Start small and follow a plan.

Is there a demo account for stock trading?

Exness offers a free demo account with virtual funds and real market conditions. It’s perfect for testing trades and learning MT5. Spend a few weeks practicing to build skills.

What strategy should I use to trade stocks?

Choose based on time and risk. Day trading is fast but risky. Swing trading holds for days, balancing risk. Long-term investing is safest for steady gains. Test on a demo to find your fit. Use charts and company data for decisions.